Deductions are a method to lower your tax burden. Or in the other words, it is the false pretense that the Government is giving you back your money. Even in the case of making a retirement contribution to a) lower your tax burden, and b) incentivize you to save, these intentions are unnecessary for a tax system in 2021.

Deductions

So how does the retirement deduction actually work? Your retirement dollars are directed towards a fund, and that fund invests in particular sectors and industries of the economy that aligns with the mission and goals of the fund manager. These are long-term investments which allow the present value of your dollars to fund future government projects — from public streets to the military industrial complex.

You can also not receive the deduction, and still contribute to a retirement which funds future government projects.

So why the deduction? Because it is the false pretense that the Government is giving you back your money. All progressive tax systems set a standard, and then there are ways to waver your standard liability by applying deductions (returning your money to you) or credits (redistribution of funds from one person to another).

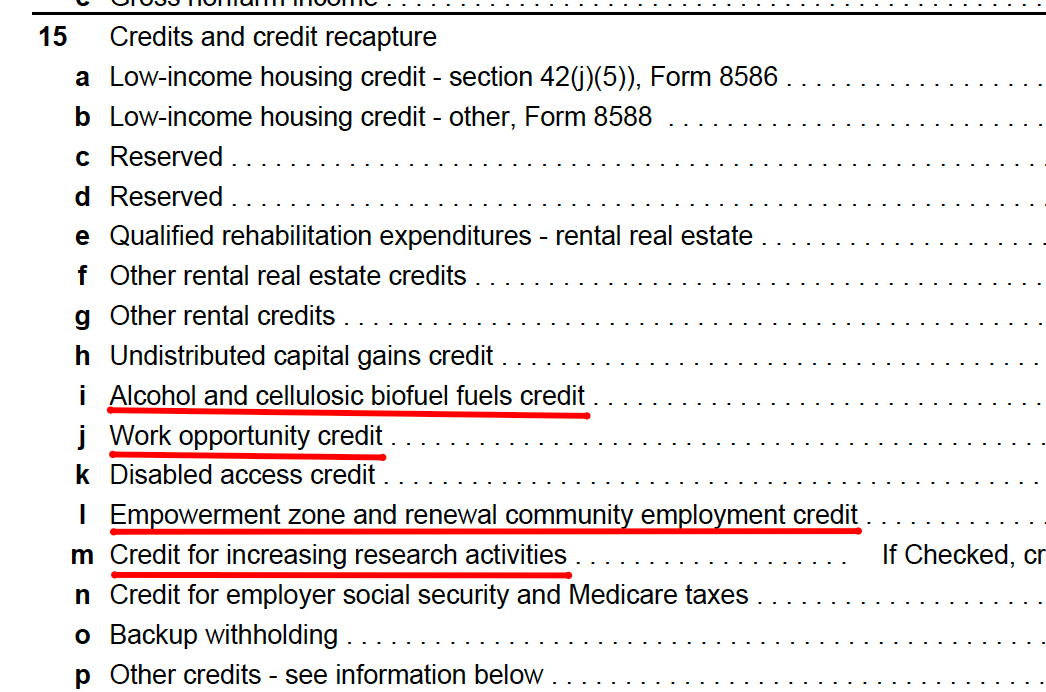

Credits

I point this out not to remove the retirement deduction (certainly, removing it minimizes the control of the government over individuals), but demonstrate that saving money is a time-tested skill that both the private and public sector believe to be necessary in any modern economy.

Lowering your tax burden and allowing you to keep that money and save it or invest it, makes you more in control of your future. Having better control of your money gives you the financial stability and security to pursue your own projects — from environmental justice to student scholarships and everything in between.

Create a fund

As a fun homework assignment, create a new virtual fund or add to an existing fund. Design the fund to have a target date to accomplish the mission of the fund. For instance, my Dedicated Lane fund aims to invest in infrastructure and automobility (like electric vehicles, mobile apps, autonomous technology) projects. My target date to realize any profit or losses is 10 years.

Other examples of projects to fund can be a student scholarship, church donations, non-profit charities, home renovations, and more. Borders do not apply as you may find an opportunity outside your native country.