Mid-Year Market Prediction

Hedging investments according to macroeconomic, corporate earnings, and options volume data

The Santa Claus market rally froze in December, but the New Year market rally is inspiring confidence. With 2022 in the books, the first month of the new year always leads to optimism about what the new year will bring. Out of the first 13 trading sessions this month in the S&P 500, seven of them colored green. So what lies ahead, and where should you hedge your investments? Let's analyze some stock market components and make calculated hedges for this 2023 calendar year.

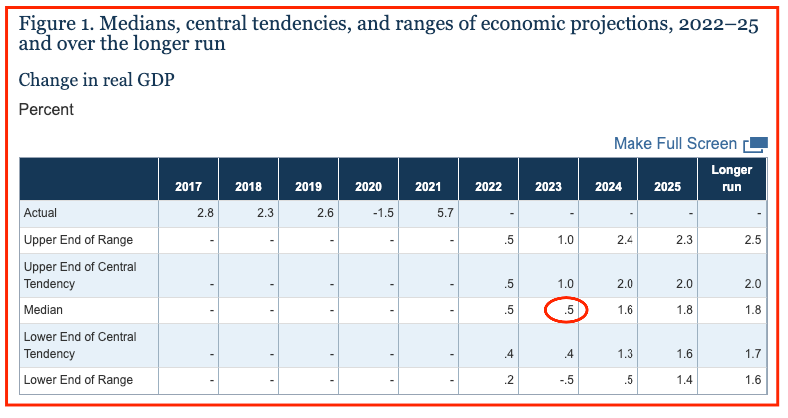

US GDP

The global financial markets in 2022 made investors' jaws drop at the amount of wealth lost. Still, the US economy squeaked through this economic downturn with a slightly positive GDP. At the end of 2022, the US economy outputted 0.5% of goods and services. Not impressive, but it's not negative.

With rising interest rates and corporations laying off employees, there exists a fair amount of uncertainty for 2023. The Federal Reserve, the central bank of the US, expects economic output this year to repeat at a meek 0.5%. A positive GDP number is...well, a positive number. But not all sectors of the economy will remain flat.

—} Learn more about GDP {—

A Peek Inside the Big Banks

Providing insight into the consumer economy, the big four banks -- Bank of America BAC 0.00%↑, Citi C 0.00%↑, JP Morgan Chase JPM 0.00%↑, and Wells Fargo WFC 0.00%↑ -- reported Q4 2022 earnings last Friday. Each bank sparingly whispered economic insight based on the health of consumer bank accounts and consumer spending.

Brian Moynihan, CEO of Bank of America, informed shareholders that they produced more than 1 million new credit cards at the behest of their customer base. In this economic downturn, it's not surprising that US consumers are hardly cutting back and instead finding new money to fund their habits. US consumerism has always been gluttonous, and inflated prices just mean that your friend drives instead of you. To this end, Bank of America saw an increase of $169M of charge-offs where businesses and consumers completely defaulted on paying their outstanding credit balances in Q4.

But where are consumers spending money?

"They're also moving from goods to services and experiences and spend more money on travel, vacations and eating out and things like that. That is a good for unemployment but continues to maintain service-side inflation pressure," touted Moynihan.

Spending money on discretionary goods is a consensus reached by all major banks. Jeremy Barnum, CFO at JP Morgan Chase, reported on their earnings call: "Both discretionary and non-discretionary spend are up year on year, with the strongest growth in discretionary being travel."

Trips to Cancun, Mexico, are up. Apple iPhones are down.

But, consumers are still spending on one good -- new cars. Like the financial markets, used car values similarly plummeted in the second half of 2022. Coupling this factor with aggressive incentives by manufacturers, this resulted in higher new vehicle loan originations as reported by Wells Fargo CFO Mike Santomassimo on their Q4 earnings call:

"Of note, our new vehicle originations surpassed used vehicles in the fourth quarter, reflecting a combination of credit tightening actions that we've implemented and the industry dynamics of higher new vehicle sales growth."

While consumers may have seen it financially smarter to buy the cheaper, older used car, Wells Fargo tightened up their application process, leaving the door open for consumers to receive higher loan amounts, but for less risky assets.

Overseas, consumers faced a different hurdle. Jane Fraser, CEO of Citibank, shed some light on Europe and China's economy:

"In Europe, a warmer December reduced the stress on energy supplies and inflation is beginning to ease off its peak. That said, we still expect softening of economic conditions across the Eurozone this year given some of the structural challenges it is grappling with. In Asia, while the public health impacts in China are unfortunately likely to be severe, the abrupt end of COVID zero should begin to drive growth and improve sentiment generally. And here at home, the labor market remains strong and holiday spending was better than expected, in part because consumers have been dipping into their savings."

The Big Four Banks are telling us a story, and if you are reading between the lines, that story has a subdued ending.

How will the first half of 2023 end?

Investors like to play games, and this year's game is "The Price is Right." The game where contestants say what the price is of particular goods and services, except instead of goods and services, investors are saying what the stock market indices will show on June 30, 2023.

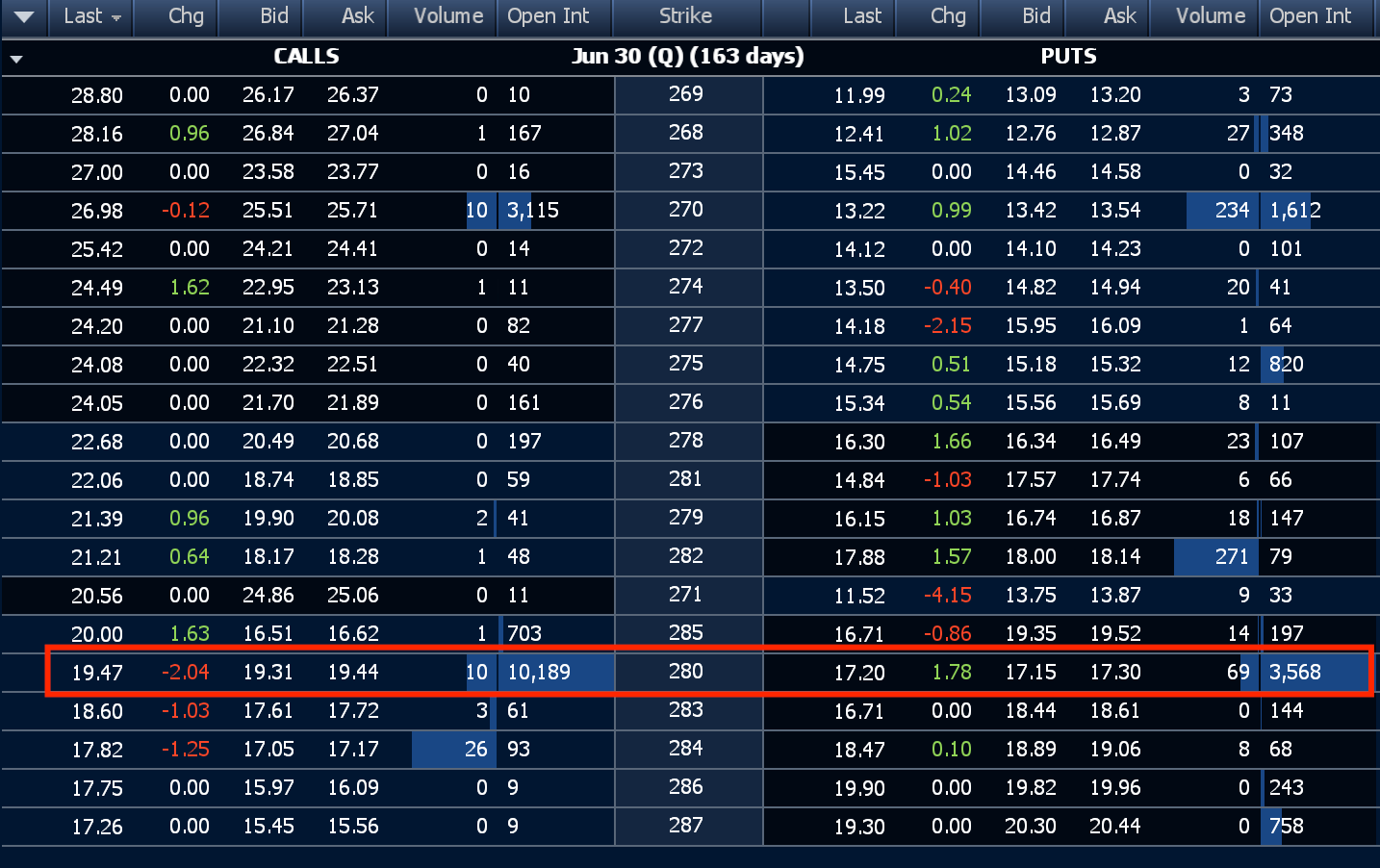

As we turn to the options market to see where investors are hedging their bets, we observe the volume of the options market of specific ETFs that track the major indices. In particular, SPDR S&P 500 SPY 0.00%↑ tracks the S&P 500, Invesco QQQ 0.00%↑ tracks the Nasdaq, and SPDR Dow Jones Industrial Average ETF DIA 0.00%↑ tracks the Dow Jones Index.

Here's where investors see the major indices landing based off the corresponding ETF by June 30. (Please note that the options volume constantly changes throughout the year.)

SPY

At close of market, the share price of SPY 0.00%↑ is $395.71, and there are 17K bets or puts that SPY 0.00%↑ will be at or below $385 by June 30. In contrast, there are 3,300 bets or calls that SPY 0.00%↑ will land at $400 or above by June 30.

DIA

Current share price of DIA 0.00%↑ is $333.53, and where the price will be mid year is not as certain as measured by the options volume. There are 965 puts that DIA 0.00%↑ will be at or below $330, and there are 419 calls that DIA 0.00%↑ will be at or above $333.

QQQ

Lastly, the current share price of QQQ 0.00%↑ is $282.68. What is interesting about this ETF is based off the options volume, there are 3,500 bets that the price will be at or below $280, and there are 10K bets or calls that the price will be at or above $280.

However investors decide to hedge, use all the macroeconomic and corporate earnings data as possible to make the best calculated decision.